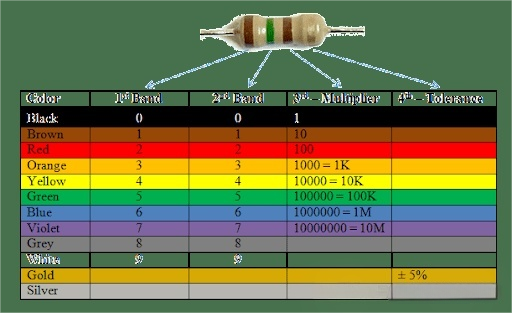

On December 4, 2025, global connector leader TE Connectivity (hereinafter referred to as "TE") issued a price adjustment notice to its global channel partners, announcing that from January 5, 2026, it will implement price increases for all product lines and regions. This is another full line price increase after several rounds of structural price adjustments in the past, covering multiple categories including automotive connectors, high-speed communication connectors, industrial automation connectors, and sensing products.

Against the backdrop of continuously rising manufacturing costs, strong structural demand, and persistent global inflationary pressures, TE's action is not surprising, but it is enough to trigger a shock throughout the entire supply chain. This article will analyze the market signals behind this price increase from three dimensions: the event itself, the logic of the price increase, and the impact on the industry.

.jpg)

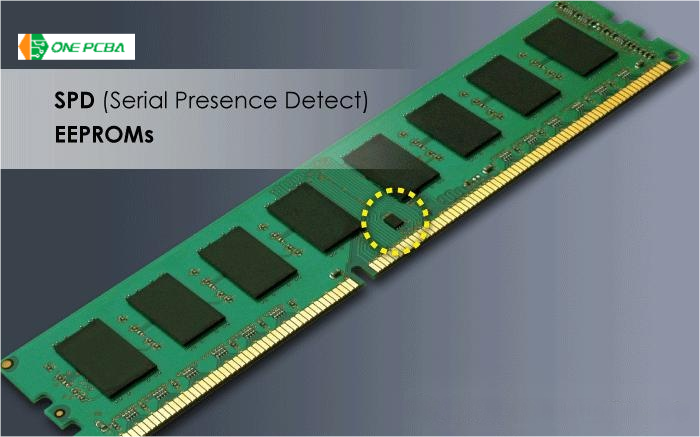

1 What are the characteristics of TE's price increase this time?

According to TE's latest channel notification, this price adjustment includes three obvious features:

Effective for all regions: This price adjustment is not just a trial price increase in regional markets. The announcement clearly states that it applies to all authorized dealers and emphasizes "global consistency".

Full product line usage: from automotive connectors to high-speed backplanes, from wire spring terminals to various industrial connectors, with a wide range of price increases. Some categories have received feedback from dealers that the price increase ranges from 5% to 12%, indicating a moderate intensity of structural price hikes.

Resolutely taking action: In the past five years, TE has repeatedly carried out structural price increases during periods of metal price fluctuations and small-scale economic upswings. For example, on December 15, 2021, TE announced a price increase, but the increase was within the range of 5% to 10%, mainly concentrated in high-performance categories. And this time it is' comprehensive coverage ', which means that its judgment on future cost curves and demand structures is very clear.

(1).png)

From a historical perspective, TE's price increases usually have a guiding significance, as it holds a leading position in the global connector industry in terms of market share, technological discourse power, and coverage. This official announcement has given the industry new expectations for the cost trend of connectors in the first half of 2026.

2 Why is there a price increase?

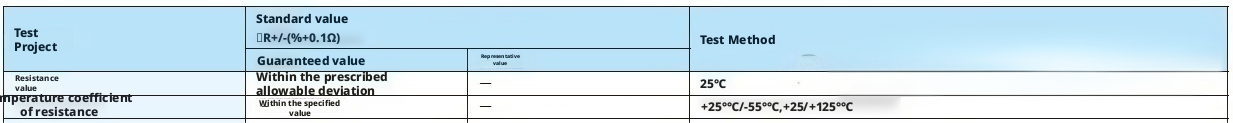

According to the TE price adjustment notice, this price increase is "affected by multiple factors such as inflation and rising prices of metal raw materials".

Global inflationary pressure persists: TE's first reason in the price adjustment letter is "global inflation". According to the "Economic Expert Survey" released by the renowned German think tank Ifo Institute for Economic Research on August 18th, economists from many countries generally predict that global inflation levels will continue to remain in a relatively high range in the coming years. Under inflation, raw materials, labor, and manufacturing services (such as electroplating, stamping, and injection molding) still show varying degrees of increase, especially for large multinational enterprises with global scale production, the cumulative effect of comprehensive costs is very obvious.

Copper prices and precious metal coatings have fluctuated significantly: Since 2025, the operating range of copper prices has significantly increased. On December 8th, Caixin News Agency reported that LME copper prices have expanded, breaking through $11705 per ton and setting a record high. The research report by CITIC Securities predicts that $12000 will become a new starting point for copper prices. The industry chain generally acknowledges that cost pressure is no longer manageable - copper prices have risen by about 10% to 18% within a year; Silver, gold and other precious metal coating materials maintain a high level; The prices of electroplating chemicals fluctuate frequently, with some categories experiencing a 15% increase.

For core components such as terminals, busbars, wire spring components, and shielding parts in connector manufacturing, material prices almost directly determine the cost composition. TE is one of the world's largest users of copper based terminals, and the material end pressure has the power to drive price increases.

International Cable and Connection believes that in addition to inflationary pressures and rising material costs, high-performance demand remains an important driving force for this round of price increases.

From 2024 to 2025, the demand for automotive high-voltage high-speed connectors, AI servers and high-speed data center interconnection, and industrial automation and new energy equipment interconnection will maintain high-speed growth. Its related products have common characteristics such as high specifications, high material costs, difficult delivery, high R&D investment, and limited capacity expansion.

Against the backdrop of supply-demand mismatch, the industry consensus has become that "high-end scarce goods are rising in price". TE has further expanded its price range from high-end to all product categories, essentially reflecting its confidence in future demand intensity and a reassessment of changes in supply and demand structure.

3 What industry impacts may price increases have?

The price increase of industry leaders' products is not just a single brand behavior, but often triggers a systematic response in the global supply chain, especially in the connector industry where TE is located, which is in a special cycle of "high manufacturing costs+rising high-end demand".

.png)

More foreign companies follow up with price increases: The industry generally believes that the signal released by this price increase is clear: the global cost side is unlikely to significantly decline in the first half of 2026; The demand for high-performance connectors is still expanding; International giants tend to take collective actions in order to maintain their gross profit structure. Companies such as Molex, Amphenol, and Anbofu may implement partial price increases based on their own product categories, most likely concentrated in high-speed interconnection, automotive high-voltage, and industrial charging products.

In the short term, there is a "rush replenishment" in the inventory cycle: it is still some time before TE officially adjusts prices, but some distributors may place orders with TE in advance and purchase certain key products at prices that have not increased. This is common in the history of TE price increases: 3-4 weeks before the price increase, there is a "replenishment peak"; Demand returns to rationality after price increases; In the medium term, the industry will return to a normal pace. For automotive, industrial control, and power equipment customers with stable demand, such price increases often stimulate "price locking replenishment", especially for models with tight delivery.

Downstream terminal products have entered a new period of cost increase: in the short term, the costs of automotive wiring harnesses, industrial equipment, server machines, and other products will be transmitted. For Tier1 and OEM companies that rely on TE's high-end product system, there is limited room for substitution, and price increases can only be partially absorbed. Especially as car manufacturers are in the stage of accelerating the implementation of electrification and intelligence, the value of connectors per vehicle continues to grow; The demand for AI servers is still high, and high-speed interconnect devices are irreplaceable. Therefore, it is highly probable that downstream price increases or profit margins will be reduced.

Domestic substitution brings structural opportunities: every time an international leader raises prices, it creates a window for domestic enterprises. But the previous domestic substitution mostly stayed at the "expansion of low-end market share", while this time it is "expansion of high-end gap+price increase of international giants". Clear beneficiary direction: high-voltage vehicle standard connectors and wiring harnesses; Industrial automation and energy storage connectors; High speed and medium speed communication connectors; High power and new energy side connection busbar; Special connectors with complex structures and high flame retardant requirements. If domestic enterprises enter a mature stage in reliability, terminal materials, precision molds, and electroplating consistency, they will have more opportunities for Tier 1 certification.

Conclusion

TE's price adjustment notice is like an industry trend forecast: the competition among connector companies in the future will no longer be limited to scale and price competition, but will focus on the comprehensive strength competition of high-performance technology breakthroughs, high material cost control, and high reliability quality assurance.

For the entire interconnection industry, this is not only a survival challenge under cost pressure, but also a strategic opportunity for technological upgrading and market restructuring.