Friday, November 21, 2025The two price increase notices from the Taiwanese passive component giant Yageo's subsidiary KEMET in April and October this year directly caused a stir in the industry. Tantalum capacitors, which are somewhat "niche" compared to ceramic capacitors, have been pushed into the spotlight. What is causing the price increase of tantalum capacitors? What is the current reaction in the spot market? What are tantalum capacitors? What kind of segment market is this?

Yageo's two price increase notices, Source: Reader's social media feed

01

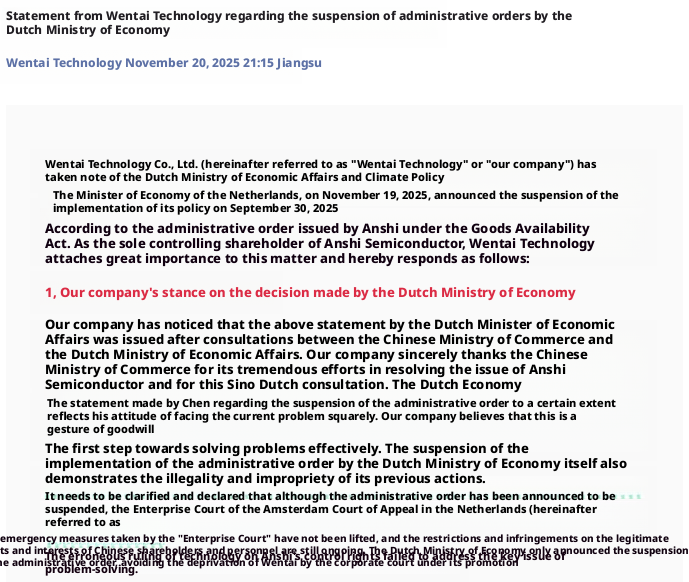

Successive Price Hikes for Passive Component Tantalum Capacitors by Manufacturers

To understand these issues, we must start with Yageo's two price increase notices. In October, KEMET issued a tantalum capacitor price increase notice to customers, primarily due to a significant increase in demand for its Polymer Tantalum Capacitor product line (KO-CAP) across multiple key market segments over the past three years, coupled with rising pressures from labor, material, and equipment costs. Therefore, price adjustments will be implemented for large case size products. Effective November 1st, price increases will apply to the T520, T521, T530 series, suitable for case sizes D, V, X, Y, with voltage ranges from 2.5V to 25V, and other related series of polymer tantalum capacitors. The supply chain revealed that this price increase is as high as 20-30%.

KEMET's April price increase notice indicated that over the past three years, demand for the polymer tantalum capacitor product line (KO-CAP) had significantly increased in multiple key market areas. Faced with rising labor, material, and equipment costs, maintaining profitability for legacy part numbers (especially case size B) was difficult, leading to price increases for some specifications in the polymer tantalum capacitor product line, effective June 1. At that time, the supply chain indicated the increase was in the double-digit percentage range.

It is reported that compared to the first price increase in June, the November adjustment extends from distributors to direct sales customers, covering a broader scope. Additionally, the June increase primarily targeted small and medium case size, low-voltage, and legacy specification products, mainly due to cost pressures. The November increase, however, is not only due to cost pressures but also focuses on large case size, high-voltage products, which are key components in high-end applications like AI servers and GPU power modules.

Although Yageo's tantalum capacitor price hikes are the most discussed, Yageo is not actually the first to raise prices. Circulated price increase notices show that some domestic manufacturers, Panasonic, and AVX (Kyocera) have also successively raised prices over the past year (subject to official announcement):

December 1, 2024: Xiangjiang raised prices for standard tantalum capacitors by 20%. Reason: Production and operation planning.

April 1, 2025: Panasonic raised prices for polymer tantalum capacitors. Reason: Increase in raw material and production costs, some part numbers increased by up to 25%.

May 27, 2025: Xinyun raised prices for tantalum capacitors. Reason: Price increases for metals like tantalum and silver.

June 1, 2025: KEMET raised prices for polymer tantalum capacitors. Reason: Rising labor, material, equipment costs, primarily for case size B.

June 8, 2025: Kyocera AVX raised prices for standard tantalum capacitors. Reason: Increased raw material tantalum costs.

September 19, 2025: Kyocera AVX raised prices for standard tantalum capacitors. Reason: Increased raw material tantalum costs.

October 22, 2025: KEMET raised prices for polymer tantalum capacitors. Reason: Rising labor, material, equipment costs, primarily for case sizes D, V, X, Y.

Circulated Kyocera AVX Tantalum Capacitor Price Increase Notice, Source: Reader's social media feed

Behind such a widespread price increase for tantalum capacitors, manufacturers have pointed to a common reason: rising costs of the raw material tantalum metal.

Tantalum powder and tantalum wire are key raw materials for manufacturing tantalum capacitors. Approximately 60%-65% of global tantalum (in the form of powder and wire) is used in tantalum capacitors, making tantalum capacitors the largest downstream application for tantalum metal. Because of this, tantalum capacitors are highly dependent on the tantalum metal supply chain.

From the resource perspective, global tantalum resources are highly concentrated, and prices have obvious cyclical characteristics with significant fluctuations.

Global tantalum mine production in 2024 was about 2100 tons, with the Democratic Republic of Congo (DRC) ranking first with about 880 tons, accounting for about 42%; Rwanda about 17%; Brazil about 10%.

Imbalances in global tantalum supply and demand over the past 20+ years have repeatedly caused significant price fluctuations. Data from Guohai Securities shows that before 2010, tantalum ore prices were around $30-45/lb. After the global economic recovery from the financial crisis, prices reached a historical high of $135/lb in 2011. Later, due to factors like US-China trade friction and the COVID-19 pandemic, prices fluctuated again, rising above $100/lb before subsequently falling. This year, affected by conflicts in the DRC region, tantalite prices surged impulsively, reaching around $90/lb by September.

Overall, high concentration of tantalum resources, sensitive supply-demand dynamics, and frequent geopolitical and macroeconomic disturbances create the highly volatile characteristic of tantalum prices. This year's widespread price increases for tantalum capacitors are attributed by various manufacturers to factors such as rising upstream raw material prices and increased demand from certain downstream sectors. KEMET noted in its price increase notice that demand for its tantalum capacitors has grown significantly in multiple key end markets (such as AI, detailed later),叠加 various cost increase factors.

This year, the tantalum capacitor spot market demand has also experienced some fluctuations due to widespread manufacturer price hikes.

Manager Fu, who mainly deals in AVX tantalum capacitors, told us that their customers are mostly traders, with some end customers involved. The relevant original manufacturers issued price increase notices in June this year. Before that, in April-May, market demand indeed increased, especially in April when demand was highest, basically customers would buy upon quotation. There was another wave of price increases in June due to the notices, and the recent wave was in October with KEMET's second notice. But now, towards the end of the year, overall demand is not as strong as it was in April-May. This year, tantalum capacitor demand has increased somewhat, but performance has only seen a slight increase.

Another tantalum capacitor distributor said they handle both domestic and international brands, with wide application coverage. There was indeed a wave of activity after the Chinese New Year this year. Prices rose significantly in the second half of the year, and as year-end approaches, customer demand is better than before.

Regarding prices, Manager Fu stated that March-April saw the most drastic price increases. Many people in the market were stocking up, and prices kept rising until May-June when large quantities arrived, causing prices to drop slightly, but they remain higher than conventional levels last year. Taking the AVX general-purpose tantalum capacitor TAJA106K016RNJ as an example, the unit price was around 0.33 yuan before March-April, rose to 0.48 yuan in March-April, dropped to around 0.42 yuan in May-June, and is now around 0.4 yuan by the end of November.

Regarding lead times, according to Future Electronics' 2025 Q4 Market Outlook Report, lead times for polymer tantalum capacitors from multiple manufacturers like AVX, Vishay, Panasonic are showing signs of extension, with deliveries affected by AI applications. A distributor added that AVX's standard tantalum capacitor lead time is 16 weeks, and currently standard tantalum capacitor lead times have reached 16-20 weeks, slightly longer than the standard lead time.

Source: Future Electronics

Multiple tantalum capacitor distributors indicated that although tantalum capacitor prices have indeed risen, the market situation is also influenced by other factors, such as competition within the industry and changes in demand. Overall, compared to the price increase trend, the performance increase is relatively less pronounced.

A contact dealing with both domestic and international brands said their customers are mainly in the security and communication fields. This year, due to restricted exports to Europe and the US, demand has decreased significantly, coupled with weak domestic demand, the overall market is very competitive.

A contact mainly promoting domestic tantalum capacitors said, "Performance hasn't improved much this year, it feels like there are more competitors." Their demand comes from communications, medical, and industrial control sectors. Tantalum capacitor demand has increased this year, but some market share was taken by aluminum capacitors. Domestic price changes have not been significant. There has been an increase in requests for replacements this year, mainly coming from those using AVX, while few requests come from those using KEMET, as there isn't much stock in the market.

One distributor saw increased demand this year, receiving many inquiries for Vishay tantalum capacitors, mainly for use in AI, but actual transactions were few, with generally low accepted prices. Vishay is the most expensive brand among tantalum capacitor brands.

Overall, compared to chips, the application scale of tantalum capacitors is relatively small, and the fluctuations caused by price increases are not that frenzied. Moreover, tantalum capacitors can be replaced by other passive components in some cases, or substituted with domestic alternatives. A procurement professional who frequently buys AVX and KEMET told us that prices for these brands have increased this year, and customer demand has decreased compared to last year. Except for automotive, industrial, and medical applications, some customers in the consumer field have already switched to domestic alternatives.

02

What is the Tantalum Capacitor Market Like?

How are the Key Players Performing?

The tantalum capacitor market is highly concentrated, primarily dominated by a few international manufacturers who master the core technologies. Among them, KEMET holds the top global market share for tantalum capacitors. In 2020, Yageo acquired KEMET, expanding its product portfolio and doubling its global footprint, significantly enhancing its strength in the tantalum capacitor field. Following KEMET are AVX (a Kyocera subsidiary, 26% market share), Panasonic (14% market share), Vishay (10% market share), etc. Domestic tantalum capacitor manufacturers mainly include Zhenhua Xinyun Electronics, Torch Electron, and Hongda Electron.

Source: Yageo 2024 Financial Report

In the passive components field, capacitors, inductors, and resistors constitute the three major product categories, with capacitors having the largest scale, accounting for about 65% of the entire passive components market. Tantalum capacitors are one of the four core categories within capacitors (Ceramic / Aluminum Electrolytic / Tantalum / Film Capacitors).

Tantalum capacitors have higher costs and a smaller market share (12%) compared to the other three capacitor types. However, tantalum capacitors offer high reliability, low leakage current, stable performance, and extremely high electric field strength, making them suitable for scenarios requiring high capacitor reliability, such as industrial and military fields, possessing advantages that are difficult for the other three capacitor types to replace.

According to Market Reports World, consumer electronics is the largest segment for tantalum capacitors, accounting for over 35%. Among smartphones shipped in 2023, about 43% used at least one tantalum capacitor. The automotive industry further drives this growth; in 2023, over 96 million vehicles were produced globally, with 45% of them embedding tantalum capacitors in ADAS and infotainment systems.

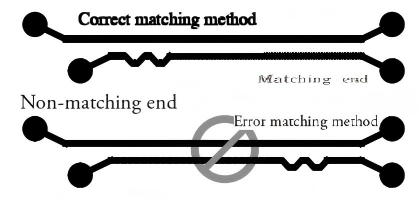

Tantalum capacitors can be divided into two main types: standard tantalum capacitors and polymer tantalum capacitors. Standard tantalum capacitors use manganese dioxide as the electrolyte, have higher ESR, and average ripple current withstand capability. Polymer tantalum capacitors use conductive polymer as the electrolyte, have lower ESR, can withstand higher currents, offer more stable performance, and are safer.

The shift towards polymer technology for standard tantalum capacitors is the current development direction, constantly adapting to market needs. Compared to MLCCs (ceramic capacitors), polymer tantalum capacitors easily achieve higher capacitance ranges (e.g., 1000μF -- 2200μF) with a price advantage. For example, in NVIDIA's Blackwell AI servers GB200 and GB300, Vishay-produced polymer tantalum capacitors are extensively used to achieve minute-level discharge. The usage of tantalum capacitors per AI server is 2-8 times that of traditional servers, with the proportion of polymer tantalum capacitors increasing to 50%, and usage in high-end models equipped with GB200 even exceeds 10 times.

Market Reports World data shows that the global tantalum capacitor market size was valued at approximately $2.59 billion in 2024, and is projected to reach $4.32 billion (about RMB 30.7 billion) by 2033, with a compound annual growth rate (CAGR) of 5.9% from 2025 to 2033. The Asia-Pacific region leads consumption with over 52%, driven mainly by growth in the electronics and automotive industries.

The tantalum capacitor market is not large; compared to the scale of ceramic capacitors, which is tens of billions of dollars, it is considered a small market within the capacitor industry. However, it excels in its high specialization, high barriers to entry, and high value, playing a role in some critical scenarios.

By looking at the latest performance of the four major tantalum capacitor manufacturers - Yageo (KEMET), Kyocera (AVX), Panasonic, and Vishay - we can glimpse the application trends of their products.

Yageo (KEMET): Strong AI Demand Momentum

Yageo is the leading passive component manufacturer from Taiwan. Over the years, through mergers and acquisitions, it has continuously expanded its product lines, becoming the world's largest chip resistor (R-Chip) and tantalum capacitor manufacturer, and the third largest multilayer ceramic capacitor and inductor manufacturer.

Before acquiring KEMET, Yageo primarily focused on MLCC and resistor products. After acquiring KEMET in 2020, its product structure rapidly expanded to comprehensively cover "Resistors + Capacitors + Inductors/Magnetic Components," particularly strengthening the layout of tantalum capacitors and high-end capacitor products. This achieved an upgrade from a single passive component type to a full range, and from the general market to the high-end market, contributing significantly to Yageo's profits. During its peak period (2021‑2022), the gross profit margin remained around 38%.

From 2020 to the present, although Yageo's performance has fluctuated, it has reached a relatively high level this year. KEMET's substantial price increases may further boost Yageo's performance.

According to Taiwanese media reports, the two price increases prove that Yageo has successfully extended its product portfolio into higher-end, higher-margin niche markets. In the first half of 2025, polymer tantalum capacitors already accounted for 22% of Yageo's revenue. This price increase is beneficial for directly boosting its revenue and profitability. Tantalum capacitors were traditionally mainly used in notebook products, industrial, and automotive applications. With the surge in AI server demand, the strongest growth this year comes from AI applications. Yageo previously pointed out that the company's Book-to-Bill ratio averages above 1, especially in the AI application field, reaching 1.2 to 1.3, indicating strong AI demand momentum.

Source: Yageo Financial Report

In the first three quarters of this year, Yageo's consolidated revenue was NT$96.962 billion, a year-on-year increase of 5.78%. The gross profit margin increased by 1.1 percentage points year-on-year to 35.8%. The third quarter, in particular, benefited from demand for AI and high-end application products, with net profit attributable to the parent company reaching NT$6.356 billion, hitting a high since Q4 2022, a quarter-on-quarter increase of 27.2% and a year-on-year increase of 12.9%. Looking ahead, Yageo's customer inventory has reached healthy levels, and demand for AI products continues to grow.

Kyocera (AVX): Polymer Tantalum Capacitor Order Volume is Increasing

AVX is a wholly-owned subsidiary of Kyocera and a global leading supplier of various products including electronic components, connectors, and sensors. AVX belongs to Kyocera's Electronic Components Business division, which accounts for 17.6% of Kyocera's total revenue.

The semi-annual report released by Kyocera on September 30 this year showed that capacitor demand in the Electronic Components division grew in both information & communication and automotive markets. However, affected by the continued appreciation of the Yen against the US Dollar, sales revenue for the reporting period decreased by 3.4% year-on-year.

Kyocera mentioned in its 2024 annual report that due to the expansion of the AI and SSD markets, order volumes for polymer tantalum capacitors are increasing. Product certification at the Thailand factory is underway, and production scale expansion is planned from April 2025.

Panasonic: Strong AI Server Capacitor Orders Continue

Panasonic is a globally leading comprehensive electronic solutions provider. Panasonic's capacitor products belong to the Industrial Division, which accounts for 15% of total revenue.

Panasonic announced its Q2 FY2026 (July-Sept 2025) financial results. Sales growth in the Industrial Division was driven by continuously growing demand for information and communication applications (such as AI servers), leading to increased product (capacitors, multilayer circuit board materials) sales. Profit grew, mainly due to increased product sales for information and communication applications, price adjustments, etc.

Source: Panasonic Financial Report

Panasonic emphasized that orders for polymer tantalum capacitors (Conductive polymer capacitors) used in AI servers remain strong.

Panasonic Capacitor Product Book-to-Bill Ratio, Source: Panasonic Financial Report

Vishay: Increased Smart Grid Infrastructure Sales, Continued Growth in AI Server Orders

Vishay is one of the world's largest manufacturers of discrete semiconductors and passive electronic components. NVIDIA's GB200 GPU cluster, with single-unit power consumption exceeding 2000W, uses Vishay's polymer tantalum capacitors. Orders for Vishay's vPolyTan already account for over 70% of its 2025 capacity, and lead times have extended to 3-6 months.

Vishay's Q3 2025 revenue was $790.6 million, of which Capacitors revenue was $130 million, accounting for 16.4%.

Vishay Capacitors Net Revenue, Book-to-Bill Ratio, Gross Margin, and Operating Margin for five quarters from FY2024 Q3 to FY2025 Q3 (left to right) (Unit: $ thousand)

Vishay's Historical Revenue Changes

Vishay stated in a recent earnings call that Q2 revenue in the Industrial segment grew by 2%, mainly benefiting from deliveries of capacitors for smart grid infrastructure projects led by European and Chinese automotive OEMs. The industrial market is showing signs of recovery in Q3. As new AI server power supply projects enter mass production, the company observes continuous growth in order volume. In Q3, they continued to expand customer coverage, providing product support for more AI customers. The product coverage rate for capacitors has improved, and certification work for polymer tantalum capacitors is steadily advancing.

03

Conclusion

This year, almost all major tantalum capacitor manufacturers have successively raised prices. As the leading tantalum capacitor manufacturer, Yageo's single price increase reached as high as 30%, inevitably reminding the market of the轰轰烈烈的 MLCC price surge years ago, speculating whether this is a repeat of the "old play." However, judging from the reasons for price increases announced by various manufacturers, the pressure from upstream raw material costs indeed exists objectively, and the new demand brought by emerging applications like AI cannot be ignored either. The underlying reasons are probably more complex.

In fact, recently, price increase voices across the entire passive components industry have been rising one after another; not only are capacitors rising, but products like inductors are also following suit. For example, Fenghua Advanced Tech explicitly stated in its latest price increase notice that costs for various metal materials like silver, tin, copper, bismuth, and cobalt continue to rise; the Taiwanese inductor giant Taico also announced price increases for multilayer chip beads and inductors. With these back-and-forth price adjustments, the passive components industry has suddenly become "lively." We will continue to monitor market performance regarding how subsequent market demand changes.

Certificate of Origin.png)

.png)